Category: crypto

-

UAE state-owned Emarat partners with Crypto.com to integrate Bitcoin, crypto payments at gas stations

Emirates General Petroleum Corporation (Emarat) partners with Crypto.com to introduce crypto payments at fuel stations in Dubai, marking a first in the Middle East and North Africa. This initiative allows customers to pay for fuel using Bitcoin and other digital assets directly at the pump. The UAE continues to advance as a global leader in…

-

navigating the digital financial landscape

Crypto wallets provide a range of security features to manage digital assets effectively, ensuring a balance between convenience and strong protection for users globally. The cover art/illustration from CryptoSlate may contain a mix of content, potentially including AI-generated elements.

-

Post Pectra, Ethereum now targets efficiency with 60 million gas limit expansion

Ethereum plans to increase its gas limit by 66% to 60 million units to improve transaction capacity and network efficiency. The upgrade has received support from validators and key figures in the ecosystem. This would be the second increase in gas limit this year, with potential benefits including lower transaction fees and reduced congestion.

-

Coinbase agrees to acquire Deribit in landmark $2.9 billion deal

Coinbase has agreed to acquire Deribit, a crypto derivatives platform, in a deal valued at $2.9 billion. This would be Coinbase’s largest acquisition to date. Deribit confirmed the acquisition, stating it will bring spot, futures, perps, and options under one brand. The deal is in its final stages pending regulatory approval.

-

LockBit breach exposes 60,000 Bitcoin addresses, offers bounty for hacker’s identity

LockBit, a well-known Ransomware-as-a-Service group, suffered a security breach exposing 60,000 Bitcoin addresses. Hackers exploited a vulnerability to access LockBit’s systems, leaking sensitive data like private keys and chat records. SlowMist traced a Bitcoin address to known exchanges, suggesting the stolen funds were being cashed out. LockBit offered a bounty for the hacker’s identity.

-

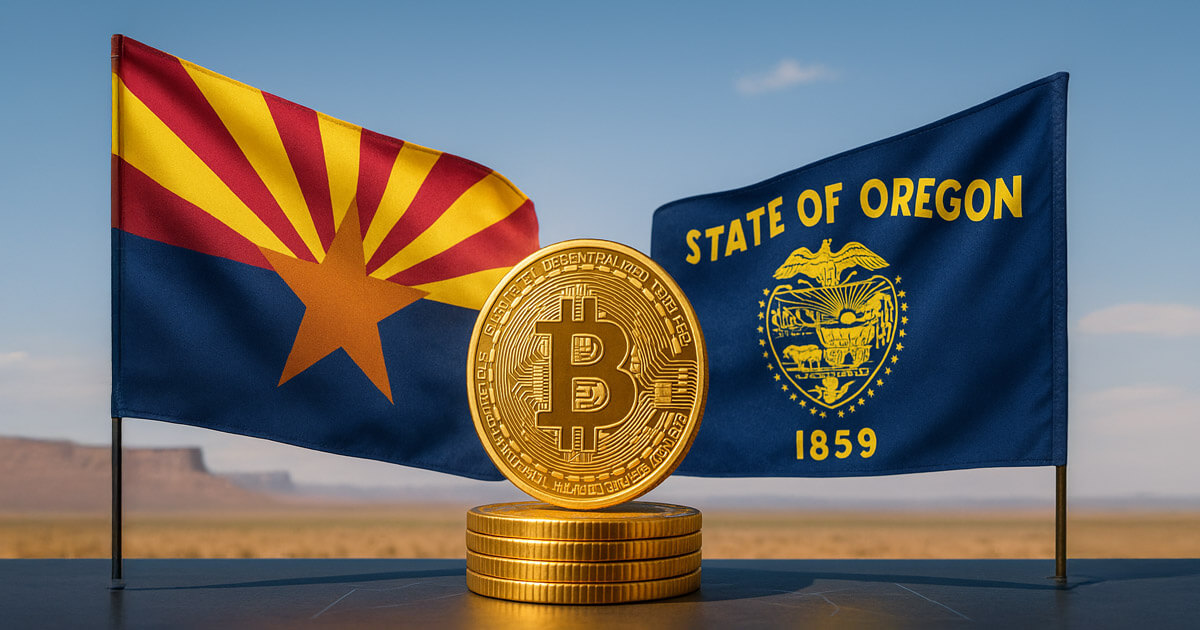

Arizona and Oregon embrace Bitcoin in sweeping new laws

Arizona and Oregon have passed laws to integrate Bitcoin and digital assets into public policy. Arizona has created a state-run Bitcoin and Digital Asset Reserve Fund, while Oregon has updated its Uniform Commercial Code to recognize digital assets as acceptable collateral. These moves signal growing acceptance of crypto at the state level.

-

BlackRock reveals $32 million Q1 revenue from Bitcoin IBIT ETF in new SEC filing

BlackRock’s Shares Bitcoin Trust ETF (IBIT) had a successful quarter despite Bitcoin’s price decline, reporting $47.78 billion in net assets. The ETF’s performance is directly correlated to Bitcoin’s market performance, with institutional interest remaining strong. BlackRock appointed Anchorage Digital Bank as a new custodian to safeguard against risks. Regulatory and market risks continue to impact…

-

Sei Labs embraces Ethereum with bold EVM-only shift eliminating Cosmos support

Sei Labs, the team behind Sei blockchain, plans to transition to an Ethereum Virtual Machine (EVM)-compatible framework, phasing out support for Cosmos transactions and CosmWasm contracts. This move aims to simplify the blockchain, improve developer experience, and align with current EVM usage trends. The proposed SIP-3 upgrade led to a 7% increase in SEI token…

-

Leverage outweighs liquidity as Bitcoin spot volumes drop 40% since January Research 1 hour ago

Bitcoin spot volumes have decreased by 40% since January, but the use of leverage in trading has increased. This shift suggests that traders are relying more on leverage than liquidity when trading Bitcoin.

-

Robinhood reportedly considering Solana, Arbitrum for new blockchain securities platform in Europe

Robinhood is working on blockchain infrastructure for European retail investors to trade US securities. They are exploring partnerships with digital asset firms like Arbitrum and Solana. The plan would expand Robinhood’s European offerings beyond crypto trading. The infrastructure would tokenize US equities for near-instant settlement and cost reductions.